Nifty opened gap up today taking positive cues from technicals and international markets at 11,351.35 with 48.05 points. However, the fear of coronavirus and profit-booking by FIIs hit the market in the first half of the day which forced the Nifty to nosedive till 11,082.15. The markets bounce back recovered in the last hour of the trading closing at 11,251 with a net loss of 52.30 points. On the daily chart, it made a Hammer. On the weekly and monthly charts also, the Nifty formed a Hammer pattern.

The DIIs were net buyers with a turnover of 764.13Cr while FIIs were net sellers with a turnover of 878.38Cr. A total of 22 stocks advanced and 28 declined from the stack of nifty 50. The closing of Nifty at 11,251 is well below 200DEMA at 11,697 and the Daily Pivot at 11,266.3. The daily Stochastic is at 27.12, in the oversold zone, while RSI is at 30.70. Nifty is in an extreme oversold zone and in the lower trendline of the ascending channel. One can expect a bounce-back towards 11,500 if the market gets some positive cues or short covering.

Nifty’s new resistance levels are 11,303, 11,356, 11,428, and 11,490 while the support levels are at 11,217, 11,152, 11,082 and 11,036. Running under threat of Covid19 Nifty remains volatile in the wide trading range from 11,082 to 11,490.

Bank Nifty also followed benchmark Nifty and closed at 28,653.70 with a loss of 523.35 points making a Bearish candle on the daily chart. New resistance levels are at 28,755, 28,956, 29,148 and 29,273 while key support levels are at 28,572, 28,305, 28,125, and 27,912. The Trading range for BN looks between 28,125 to 29,148. Max OI on CE is at 29,500 and Max OI on PE is at 28,000. With PCR for the current OC series (5th Mar) at 0.57 Banknifty indicates a negative bias and volatility.

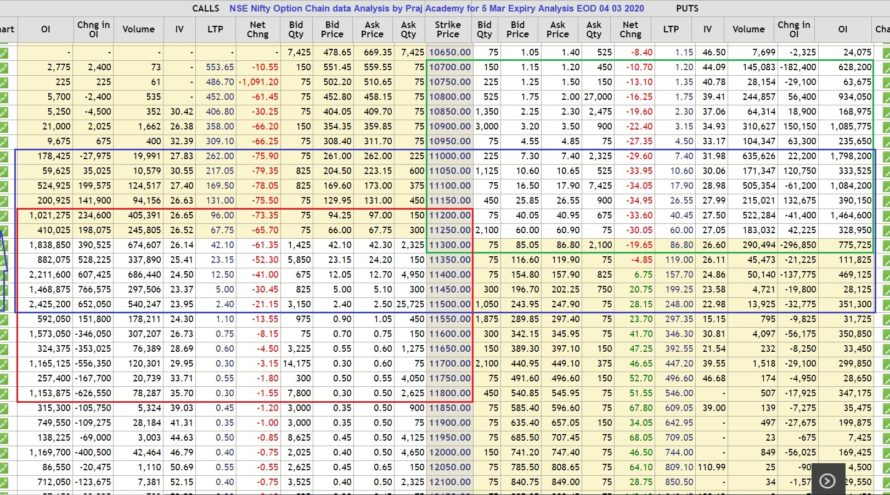

As per Nifty Option Chain data (5th Mar), Put writing was observed on lower levels 10,800,10900,11,000 and 11,050 whereas Call writing was seen at 11,100, to 11,550 levels. The unwinding of Call was seen above 11,600 levels and Put unwinding was observed above 11,300. The resistance and support levels have moved wide indicating more volatility in the coming sessions. Max OI in PE is at 11,000 and CE is at 11,500. The data of various Option Chain series suggests the 11,000 as very strong support and it may also be the end of the correction for this season. The PCR for the current series comes down to 0.71 as compared to yesterday indicating the fear of bulls and weakness in the Index. OI data shows the possibility of the next trading range between 11,000 to 11,500 with heavy volatility. Traders are advised to be careful from volatility and trade using options strategy with close stops.

Technical analysis with a sound understanding of the market is the key to trading success; however, unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!