Where is Nifty heading on Feb 18, 2020?

The benchmark Nifty opened 18.35 points up at 12,131.80 and touched days high at 12,159.60 but witnessed profit booking at a higher level. While Nifty was trying to recover from the initial bearish pressure, it got negatively impacted due to Moody’s rerating FY GDP Growth forecast to 5.4% from earlier 6.6%. The banking and telecom sectors were already under pressure due to the recent order of Apex Court pushing the index down further to days low at 12,037. Nifty closed at 12,045.80 with a net loss of 67.65 points making a bearish candle on the daily chart. On the weekly and monthly charts, Nifty formed a Bearish Engulfing and Doji candle respectively indicating negative bias and indecisiveness. Today also Nifty consolidated in the new range of 12,000 to 12,200 with volatility as estimated in our previous analysis. Nifty needs to get back in the new ascending channel again for its northward journey for which it will need strong cues from domestic and international markets.

The DIIs were net sellers with a turnover of 154.25Cr as well as FIIs were also net sellers with a turnover of 374.06Cr. A total of 19 stocks advanced and 31 declined from the stack of nifty 50. The closing of Nifty at 12,045.80 is below the 50 DEMA at 12,067 and the daily Pivot at 12,150. The daily stochastic has come out of the overbought zone and is at 43 while RSI is at 48 indicating the market may consolidate some more.

Nifty’s new resistance levels are 12,087, 12,117, 12,166 and 12,197 while the support levels are at 12,031, 12,005, 11,953, and 11,856. If Nifty slips below 11,990 level (on a closing basis) may head towards 11,750 to fill up the bullish gap and if it closes above 12,197 it will continue its journey toward 12,430. The next day trading range from the chart seems to be from 11,953 to 12,197.

Bank Nifty also faced bearish pressure due to most banks having large exposure to telcos. It closed at 30,834.80 with a net loss of 154.10 making a bearish candle. New resistance levels are at 30,776, 30,874, 30,998 and 31,139 while as key support levels at 30,541, 30,462, 30,390 and 30,235. The Trading range for BN looks between 30,500 to 31,200. Bank Nifty PCR for the current OC series is at 0.47 while PCR for next series is 0.87 which indicates a negative bias with consolidation.

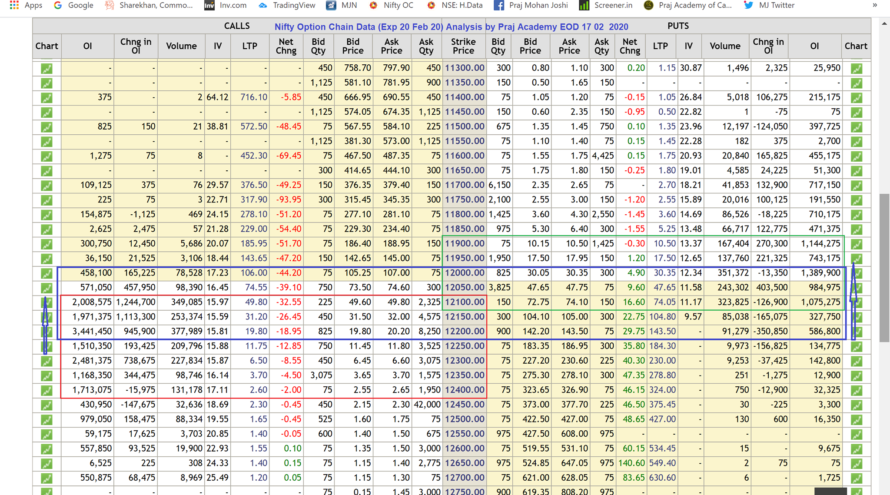

As per Option Chain data (20 Feb), Call writing was seen at 12,050 to 12,350 whereas new Put writing was observed from 11,900,12,950 and 12,050 in the current series. The resistance and support levels are wide indicating volatility in the next session. Max OI in PE is at 12,000 and CE is at 12,200. The PCR for the current series is at 0.53 and the next series at 1.13 indicating negative bias and consolidation. OI data shows the possibility of the next trading range between 12,000 to 12,200 while 12,000 to 12,300 seems to be a weekly trading range. Traders are advised to be careful and trade with close stops.

Technical analysis with a sound understanding of the market is the key to trading success; however, unexpected (domestic or international) factors make the technical analysis go haywire

for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!