And where is it heading this week from Sept 24, 2019?

The rally in Nifty and Sensex continued from the momentum of Friday, partly due to general buying in lieu of visible improvements in the financials of corporate in the coming times and partly because of short coverings by FIIS. The measures declared on Friday are by and large the biggest and the boldest steps, in the history of India, to revive the Indian economy. The DIIs were the net buyer (291.95Cr) and FIIs became the net buyers (2618.05Cr) today. 32 stocks advanced and 18 declined from stack of nifty 50.

The sentiments were already extremely bullish in the market to open the market with a massive gap up by 268.5. The market touched days high at 11,694.85 before settling at 11,600 gaining 326 points in a single day. Today’s it formed a spinning top candle, between two Fibonacci levels, on daily as well as weekly chart.

Today’s closing at 11,600 is well above the daily Pivot at 11,115.7 and Weekly Pivot at 11,108.78. Although, the Index is well midway of the ascending channel on the daily chart, however, it has got a stiff resistance at the upper trend line of a descending channel on the daily chart. Break out from this descending channel is crucial for the up move. Stochastic is at 61.32 and MACD line above zero with bullish cross over along with RSI at 65.63, are a very good sign for bulls to march on.

Nifty’s next resistance levels have shifted drastically upwards 11,607.8 (23% Fib from 03 June 2019), 11,695.4, 11,786.5, 11815, 11,904. The support levels can be seen from Nifty Daily chart at 11,543 (Golden Fib from 03 June), 11,500, 11,475, 11,418.9, 11,370 (50% Fib 03 June) and 11,301 (38.2% Fib from 26 Oct 2019).

Looking at current immediate support and resistance level for the next trading day seems to be from 11,400 to 11,800 and weekly range from 11,300 to 11,900 with a bullish bias. As the market has already shot up high and making indecisive candles on a daily and weekly chart it may consolidate for a few days before the next move. Meanwhile, small downside retracement or corrective move cannot be ruled outwards 11,475.

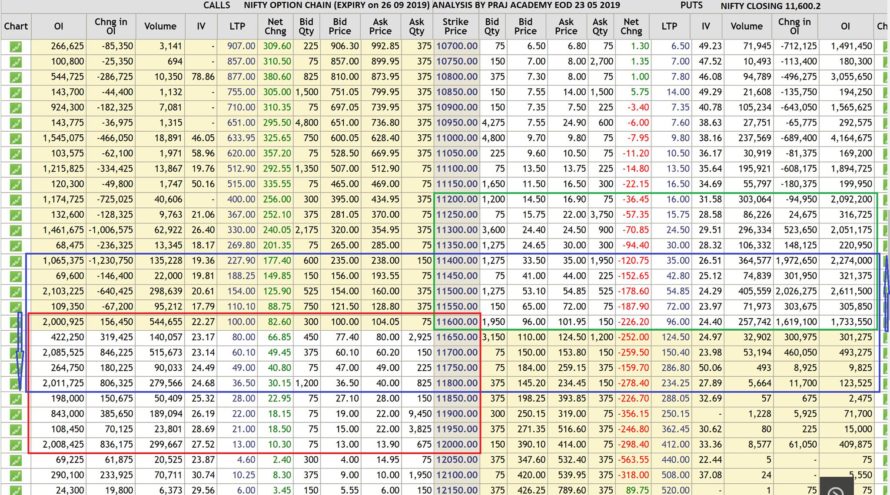

As per Option Chain data the trading range today the range of nifty has broadened for the coming week from 11,200 to 11,200 indicating good volatility. In fact, noticeable put writing was seen at higher levels i.e. 11,500 and 11,600 along Put unwinding al lower levels thus confirming support levels shifting upwards. Meaningful call writing has shifted upside at 11,800 and 12,000at along with call unwinding at lower levels indicating resistance levels also shifting upwards. Both factors are indicating bullishness. Looking at the Open Interest data at various strike rates along with the strike shifting forces indicate the possibility of higher swings and volatility in the market in the coming week.

PCR @EOD is at 1.56 which indicates bullish outlook with strength for the next trading day.

Technical analysis with a sound understanding of the market is the key to trading success, however, sometimes, unexpected (domestic or international) factors make the technical analysis go haywire for a while. Market forces are stronger then our analysis sometimes and we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money.

We trust the information provided will be helpful in your analysis of the market and make trading a profitable and better experience. The information has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!