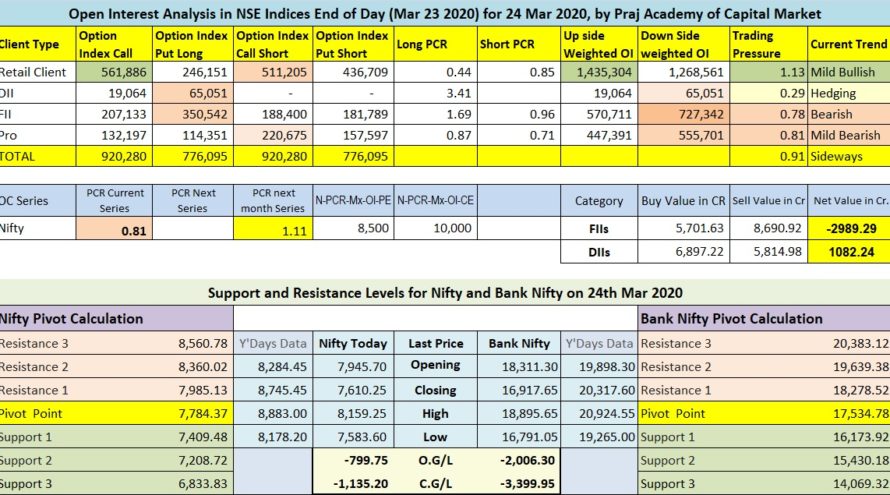

The stock markets worldwide are under tremendous pressure due to virtual lockdown for fear spreading COVID-19. The benchmark nifty hits it’s lower circuit today in the morning (second time in this month). Nifty opened a steep gap down 800 points at 8,284.45 and tried to recover the losses however, it failed to succeed and continued to fall towards 7,600 levels. Nifty closed at 7,610.25 with a net loss of 1,135.20 points making a Bearish Candle on the daily chart. On the weekly chart as well as on the monthly chart, it made a bearish candle. The market is still in the grip of bears and needs positive cues from domestic or international markets or a strong short coverage to start moving upwards. The monthly FN&O expiry is just three days away, hence, a bounce-back shall not surprise due to short-covering.

The FIIs were net sellers with a turnover of 2,989.29Cr while the DIIs were net buyers with a turnover of 1,082.24Cr. Market breadth was extremely negative with all the 50 stocks declining from the stack of nifty 50. The closing of Nifty at 7,610.25 is well below 200DEMA at 11,444 and the daily pivot at 8,602.22. The daily Stochastic is at 24 and RSI is at 19 indicating the market is still in the oversold zone and may consolidate or get a bounce-back.

Nifty’s new resistance levels are at 7,890, 8,080, 8,224, and 8,387 while the support levels are at 7,517, 7,405, 7,230.81, and 7,037.80. The fear gauge (India VIX) has again increased to 71.98 with increased ATR of Nifty and BankNifty due to fear of uncertainty of the markets which is driving the indices volatile. The daily trading range for the next session as per the Nifty chart seems to be very wide now from 6,961 to 8,387

Bank Nifty also followed the broader Index and closed at 16,917.65 with a loss of 3,399.95 points making a big bearish candle on the daily chart. New resistance levels are at 17,288, 17,767, 18,370, and 18,858 while key support levels are at 16,600, 16,373, 16,193, and 15,958. The Trading range for BN looks between 15,440 to 18,858 from the daily chart. As the data of OI for PE and CE is not available where BankNifty closed today we will not be able to calculate the PCR ratio for today.

As per Nifty Option Chain data (26th Mar), very minimal Put writing was observed at lower levels whereas Call writing was also seen from 7,000 to 8,750. A very minimal unwinding of Call was seen at lower levels whereas unwinding of Put was seen almost across all the levels. Max OI in PE is at approx 7,000 and CE is at 10,000. The maximum fresh OI is at 8,000 CE level. The PCR for the current series is 0.81 which indicates a bearishness in the market. OI data shows the possibility of the next trading range between 7,000 to 8,000 with volatile swings. Traders are advised to be careful from volatility and trade only trends with options strategies with close stops.

Technical analysis with a sound understanding of the market is the key to trading success; however, unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!