Where is Nifty heading on Feb 12, 2020?

Driven by the strong global cues today the benchmark Nifty opened higher with an upside gap of 77 points at 12,108.40. It maintained its bullish bias touching the high at 12,172.30, but the day’s gains wiped out due to profit-booking by FIIs in the afternoon. Nifty touched days low at 12,099 before closing at 12,107.90 with the gain of 76.40 points making a “Gravestone Doji”. A Gravestone Doji is an indecisive candle which (if at the top) may turn bearish on confirmation candle closing below it. Today Nifty consolidated in the range as estimated in our previous analysis in the range of 12,000 to 12,200. On the daily and weekly chart, Nifty made an indecisive candle while as on monthly a bullish. Although Nifty is moving in an ascending channel so far, it needs strong positive cues from domestic and international markets to move in the upper orbit and continue its northward journey.

The DIIs were net buyers today with a turnover of 344.63Cr while FIIs were net sellers with a turnover of 209.39Cr. A total of 39 stocks advanced and 11 declined from the stack of nifty 50 indicating a positive market breadth. The closing of Nifty at 12,107.90 is above the 50 DEMA at 12,055, the daily Pivot at 12,042 making a higher high and higher low. The daily stochastic remains close to the overbought zone at 75 while RSI is at 51 indicating the market may consolidate some more. Delhi election results had been stable and positive cue from the domestic market today. Now the macro data such as WPI, CPI and IIP need to be watched out this week to steer the market.

Nifty’s new resistance levels are 12,118, 12,151, 12,172, and 12,197 while the support levels are at 12,100, 12,060, 12,030 and 11,990. Nifty has been consolidating in a range for the last few days. If Nifty slips below 11,990 level may head towards 11,823 and if closes above 12,172 then it will continue its journey toward 12,430 The next day trading range from the chart seems to be from 11,990 to 12,197.

Bank Nifty also followed the broader market closing at 31,300.60 with a net gain of 242.45 making a “Shooting Star” candle. New resistance levels are at 31,367, 31,505, 31,590 and 31,700 while as key support levels at 31,230, 31,112, 30,957 and 30,833. The Trading range for BN looks between 30,957 to 31,505.

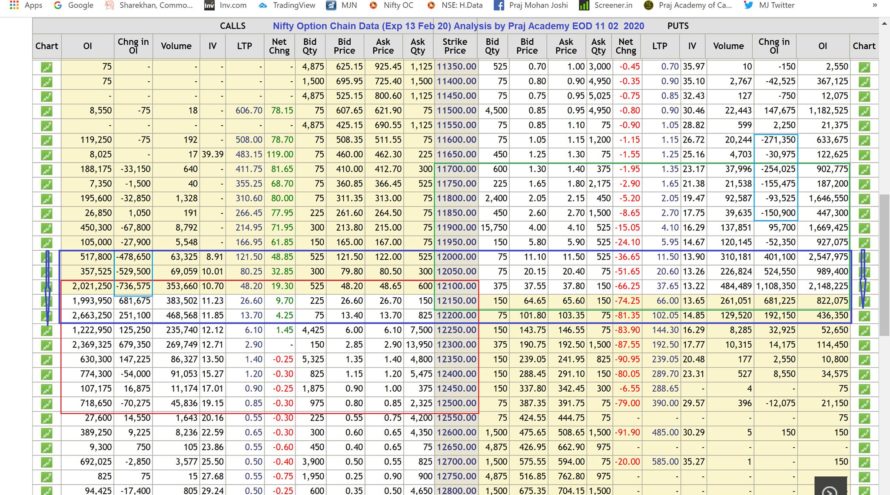

As per Option Chain data (13 Feb), Call writing was seen at 12,200 to 12,350 whereas new Put writing was observed at 12,000 to 12,200. Call unwinding was witnessed at 12,000 to 12,100 and small Put unwinding at lower levels shifting resistance and support to higher levels. Max OI in PE is at 12,000 and CE is at 12,200. The Call & Put range remains widened 11,800 to 12,500 which indicates volatility. PCR for the current series is at 1.01, next series at 1.60 and the monthly expiry series is 1.23 with overall positive bias. OI data shows the possibility of the next trading range between 12,000 to 12,200 with some more consolidation. The trading range for the week is 11,900 to 12,400. Professional traders can initiate suitable options strategies for the next trading session.

Technical analysis with a sound understanding of the market is the key to trading success; however, unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!