And where is Nifty heading on 08 Jan with new Option Series expiring on Jan 09, 2020?

The Nifty opened with a gap up with the gain of 86.1 points at 12,079.10. Sell off continued after the first hour of gain in the trading session to the lowest of the day at 12,005.35 where it got support to be 61% Fibonacci level. Nifty closed with a gain of 59.90 points at 12,052.95. NIfty made a Spinning top candle on daily and bearish candlestick on weekly & monthly charts. The Bollinger Bands are still in expanding mode upwards in monthly time frames indicating the midterm bullish strength and volatility in the coming sessions. For the last two weeks, nifty has been consolidating in a range of 12,100 to 12,300 which got broken today shifting the new range to 11,850 to 12,200. To continue its bullish journey Nifty needs to sustain above 12,250 on a closing basis, however, the upside is capped at present due to week macros and absence of positive cues from domestic and international markets. The downside in Nifty seems to be capped at 11,832 at present.

The DIIs were net buyers today with a turnover of 311.19Cr while FIIs were net sellers with 682.23Cr. 33 stocks advanced today while 17 declined from the stack of nifty 50. Today’s closing at 12,052.95 is well below the 13 DEMA at 12,147, daily Pivot at 12048 and weekly pivot at 12,222. The Index has touched a lower level of the daily ascending channels, however, the narrow ascending channel trend line is breached today. The MACD and SI have gone in sideways to a bearish mode so some consolidation and correction can be expected in the coming sessions.

Nifty’s new resistance levels are 12,079, 12,118, 12,152, 12,178, 12,200, 12,226 and 12,261 while as the support levels are at 12,005, 11,974, 11,941, 11,910 and 11,867. Looking at current immediate support and resistance level for the next trading day seems to be from 11,850 to 12,150. If Nifty is able to cross 12,152 on the closing basis it will continue it’s up moving towards 12,300 and if it slides below 11,910 level on a closing basis, it may initiate a correction towards 11,832.

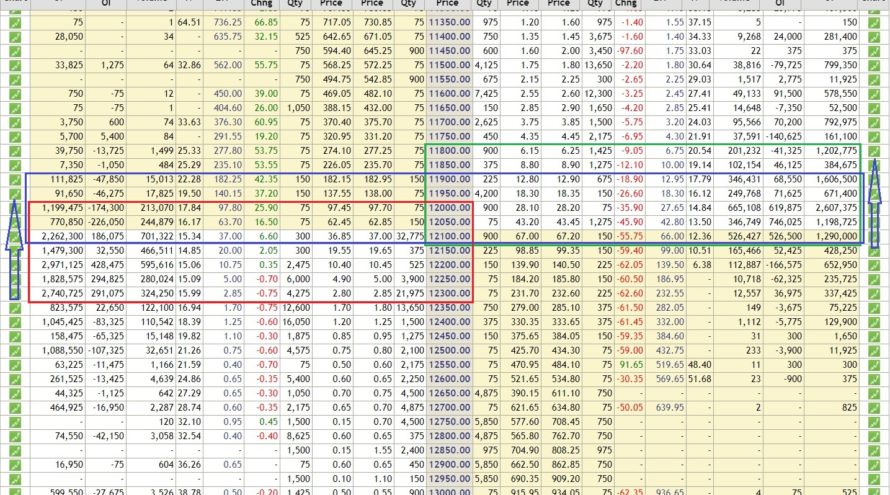

As per Option Chain data, massive Call writing was seen at 12,100 to 12,300 levels whereas a small quantity of new Put writing was observed at 11,900 to 12,100 levels. The unwinding of Calls observed on lower levels like 12,050, 12,000, 11,950, and 11,900 whereas unwinding of puts seen at 12,200 and 12,250. Max OI in PE is at 12,000 and CE is at 12,200. The Call & Put range has shifted downside and also on the broader side indicating bearishness with volatility. OI data shows the possibility of the next trading range between 11,900 to 12,100. The current PCR is bearish at 0.79 for current OC and at 0.88 for the next OC series expiring on 16th Jan which indicates correction and consolidation to continue for a while. This week the market will mainly be governed by the developments happening in the middle east and how the allies get aligned in the process of peace or war. Traders are advised not to initiate fresh long positions till there is truce and peace between the US and Iran.

Technical analysis with a sound understanding of the market is the key to trading success; however, unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!