And where is Nifty heading on 02 Jan with Option Series expiring on Jan 02, 2020?

The Nifty opened with a gap up of 34 points at 12,202.15 and saw the days high at 12,222.2 where it witnessed selling pressure in the first half of the day, touching day’s low at 12,165.3, due to profit-booking by FIIs. The market remained rangebound in the second half and closed at 12,182.5, with the gain of 14 points, making an In-Candle “spinning top” candle in the daily chart indicating consolidation and rangebound move in next trading session. On the weekly chart, it made bearish engulfing candle showing bearish bias. The Bollinger Bands were expanding upwards in all the time frames indicating the midterm bullish strength and volatility in the coming sessions. The press conference of FM for Infra Push did not impress the investor’s sentiments. The market needs positive development on government-initiated growth stimulus for the economy, reduction in LTCG on equity, Individual Tax rate cuts from upcoming Union Budget 2020 on Feb 01, 2020.

The DIIs were net buyers today with a turnover of 208.47 while FIIs were net sellers with 58.87Cr. Total 23 stocks advanced, 27 declined from the stack of nifty 50. Today’s closing at 12,182 just above the 13 DEMA at 12,170, but it’s below the daily Pivot at 12,189 and weekly pivot at 12,217 showing weakness in Nifty. The Index is still moving within the daily ascending channels; however, there were divergences observed in the daily chart in Nifty and Bank Nifty. The daily Stochastic has cooled down to 50 whereas RSI is at 56 and MACD is above zero with a bullish crossover however with decreasing bullish strength indicating some more correction and consolidation.

Nifty’s new resistance levels are 12,210, 12,222, 12,245, 12,275 and 12,294 while as the support levels are at 12,165, 12,152, 12,126, 12,100, 12,082, 12,063 and 12,008. Looking at current immediate support and resistance level for the next trading day seems to be from 12,100 to 12,293. If Nifty is able to cross 12,294 on the closing basis it will continue it’s up moving towards 12,350 to 12,408. If Nifty slides below 12,117 level on a closing basis, it may initiate a corrective towards 12,008 (61% Fib retracement from 11,832 to 12,294 move).

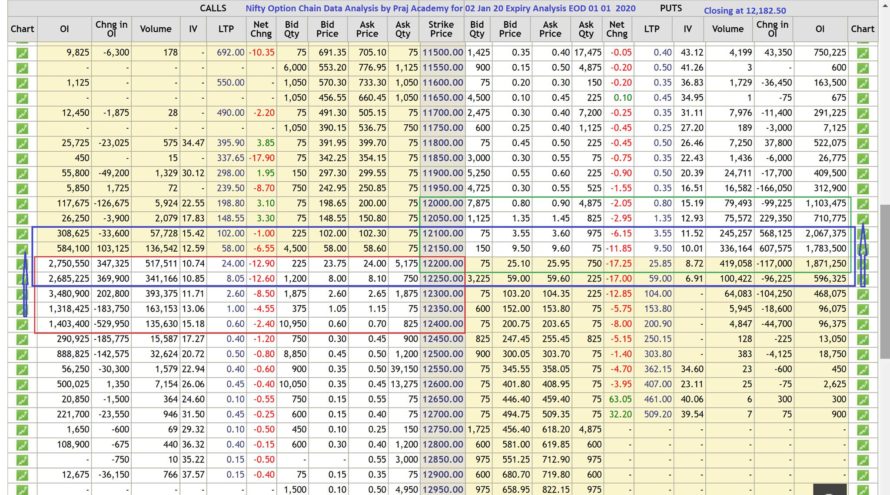

As per Option Chain data new Call writing was seen at 12,200, 12,250, and 12,300 level whereas new Put writing was observed at 12,100, 12,150. Unwinding of Calls at 12,350 and 12,400 while as Put unwinding at 12,200, 12,250 and 12,300 was observed. Max OI in PE is at 12,100 and CE is at 12,300. The Call & Put range has shifted on the lower side indicating further correction and consolidation. OI data shows the possibility of the next trading range between 12,100 to 12,250. The current PCR remains bearish at 0.77 while as its 0.96 for the next OC series expiring on 9th Jan which indicates correction and consolidation to continue for a while.

Technical analysis with a sound understanding of the market is the key to trading success; however, unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!