And where is Nifty heading on 30 Dec with Option Series expiring on Jan 02, 2020?

The Nifty reversed handsomely on Friday after a gap up a gain of 46 points opening at 12,172.90. It maintained its bullish momentum coupled by buying of bothe FIIS and DIIs. A little profit booking was observed at 12,230 level. Nifty saw days low at 12,157.9 and closed with a handsome gain of 119.25 points making bullish candle on the daily chart. In our previous analysis, we had expected the trading range from 12,150 to 12,300 having capped upside, profit-booking at 12,250 and surprise reversal from 12,117 (38.2% Fibonacci level from the low of 11,832). Nifty traded in the range of 12,157 to 12,258 with profit booking at 12,230 level and reversal from 38.2% Fib. Nifty made a very bullish candle with a higher low and higher high in the daily chart, “Dragonfly Doji” candle on the weekly and “Hanging Man” candle in the monthly chart indicating bullishness on the cards. The Bollinger Bands were expanding upwards in all the time frames indicating the midterm bullish strength and volatility in the coming sessions. The market has been taking bullish cues from Saturday’s FM meeting on PSU Banks, hopes of growth stimulus for the economy, reduction in LTCG on equity, Individual Tax rate cuts from upcoming Union Budget 2020 on Feb 01, 2020.

The DIIs were net buyers today with a turnover of 125.77 while FIIs were also net buyers with 81.37Cr. Total 42 stocks advanced, 8 declined from the stack of nifty 50. Today’s closing at 12,245.8 is well above 13 DEMA at 12,152, below daily Pivot at 12,155 and above weekly pivot at 12,204 showing good bullishness. The Index is still moving within the daily ascending channels. the daily Stochastic has cooled down to 38.7 whereas RSI is bullish at 61.6 and MACD is above zero with a bullish crossover however with decreasing bullish strength indicating bullishness with some consolidation.

Nifty’s new resistance levels are 12,269, 12,293, 12,324, 12,350 and 12,404 while as the support levels are at 12, 235, 12,211, 12,184, and 12,165. Looking at current immediate support and resistance level for the next trading day seems to be from 12,184 to 12,324. If Nifty slides below 12,184 level on a closing basis, it may initiate a corrective towards 12,117 (38% Fib retracement from 11,832 to 12,294 move) before resuming it’s up moving towards 12,350 to 12,408.

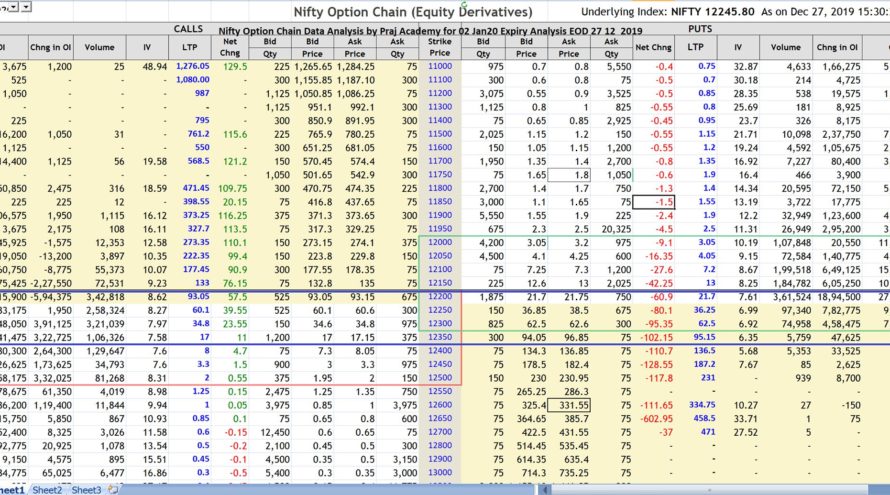

As per Option Chain data new Put writing was seen at 12,300 & 12,200 whereas heavy Put writing at 12,200,12,150 and 12,100 levels. New Call writing was seen at 12,400 & 12,500 and unwinding at 12,150 and 12,200. This pattern indicates the shifting of support and resistance levels upside and bullishness. OI data shows a possibility of the next trading range between 12,200 to 12,350 with good volatility due to options strikes OI have expanded the broader side. The PCR has increased to 1.51 for current OC series, 1.46 to next and 1.17 to month-end OC which indicates clear bullishness in coming sessions.

Although Nifty seems to be bullish one has to be selective while investing in stocks as the Nifty rally is supported by only a few stocks. Small Caps and Mid Caps haven’t caught up the momentum.

Technical analysis with a sound understanding of the market is the key to trading success; however, unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!