And where is Nifty heading on 17 Dec with Option series expiring on Dec 19, 2019?

The benchmark Nifty opened with a gap of 44.65 points with a bullish bias at 12,131.35. However, at the daily resistance level of 11,135 profit booking was witnessed as expected in our previous analysis where we had expected a range-bound move between 12,000 to 12,150. In the second half of the day, some short covering followed by further profit booking was seen taking Nifty to the day’s low at 12,046.30 before closing at 12,053.95 at the end of the day. Investor’s interest was muted during the day in await of resolution of the US-China trade war. Nifty closed with a net loss of 32.75 points making a “Dark Cloud Cover” pattern on a daily chart suggesting some corrections after a consecutive up move of three days. On the weekly chart, Index made a bearish candle where Bollinger Band still indicating the midterm bullish strength in the trend. The market will need continuous positive cues from domestic and international markets to resume its bullish journey.

The DIIs were net sellers today with a turnover of 796.38Cr while FIIs were net buyers with 728.13Cr. Total 13 stocks advanced, and 37 declined from the stack of nifty 50. Today’s closing at 12,053.95 is above 13 DEMA at 11,991, below daily Pivot at 12,069.72 and weekly pivot at 12005.95. The Index is still sailing within the daily ascending channels and has got multiple resistance and support levels. Stochastic, at 62.93 whereas RSI has strengthened to 60 and MACD is above zero with bearish crossover but increasing bullish strength indicating bullish bias building up for Nifty.

Nifty’s new resistance levels have shifted upwards to 12,086, 12,000, 12,114, 12,134, 12,147, 12158, and 12,188. The support levels are at 12,023, 12,005, 11, 971, 11,934 and 11,910. Looking at current immediate support and resistance level for the next trading day seems to be from 11,971 to 12,158. Nifty has completed the pullback move (Wave 4) which now can lead it to Leg 5 of the Elliott Wave if NIfty continues to sustain above 12,158 on closing basis for which Nifty would need strong cues to continue its journey towards 12,200 and 12,300. If Nifty slides below 11,970 level on a closing basis, it may initiate a downside to fill the gap at 11,910 before resuming its up move towards 12,158.

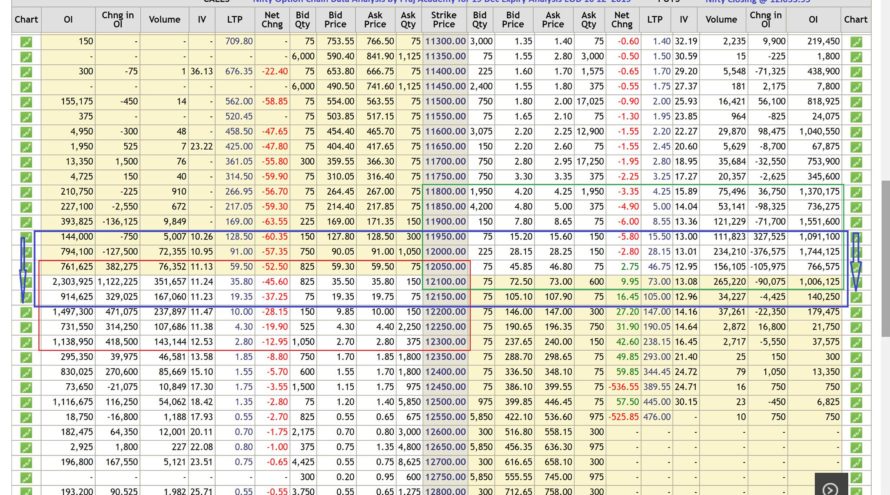

As per Option Chain data new Put writing was seen at lower levels like 11,900 and 11,950 whereas call writing was seen above 12,100, 12,150, 12,1200 and 12,300 levels shifting support and resistance levels wider side. The unwinding of Calls was at 12,000 level and for Put, it was at 12,000,12,050 and 12,100 indicating rising volatility. The trading range has expanded quite wide for the next trading range. Looking at the Open Interest data there is a good possibility of the next trading range between 11,950 to 12,150. The weekly trading range seems to be broader from 11,900 to 12,324. The PCR, today, of current options chain series is at 1.08 while as its 1.32 for 26 Dec series option chain which indicates mild bullishness and consolidation. If the index moved toward 12,150 some profit booking may start by FIIs due to long Christmas vacation which may further lead to volatility and short term correction/consolidation. The market moves will be affected by the decisions of the GST council, PMs view on the economy, debt recovery by banks from other NPAs, international cues, etc.

Technical analysis with a sound understanding of the market is the key to trading success, however, unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!