And where is Nifty heading on 26 Nov with Option Series expiring on 28 Nov 2019.

Nifty opened almost flat at 11,922 and witnessed excellent power of bulls breaking the strong resistance at 12,038. Once 12,038 level was broken bears fuelled the up move up to 12,084.5 by short covering which is evident from massive cal unwinding at higher levels. Nifty closed at 12,073.75 with a big bullish candle and net gain of 159.35 points during the day. The FIIs were bullish today with net buying of 960.90Cr while DIIs were the net sellers with -213.66Cr. From the Nifty 50 stack, 44 stocks advanced, and only 6 stocks declined today indicating the bullish structure of NIfty.

Today’s closing is placed well above daily Pivot at 11,922, weekly Pivot at 11,940.2 and above 200 DEMA at 11,368. Stochastic is at 60.34, RSI is at 66.96 while MACD is still above zero with a weakening bearish crossover indicating the completion of correction and the consolidation phase. Nifty’s bullish structure is still intact in the mid-term while as there may be some consolidation in the short term. If the index manages to sustain above 12,119, then we may see its bullish journey towards 12,190 and 12,209.

The daily resistance levels are at 12,088.5, 12,119.5, 12,132, 12,150 and 12,190 while as support levels are at 12,052, 12,038, 12,005, 11,973, 11,950 and 11,930 and 11,905 for intraday trading. Looking at current immediate support and resistance levels at 60 minutes chart the next day trading range seem to be between 11,950 to 12,150.

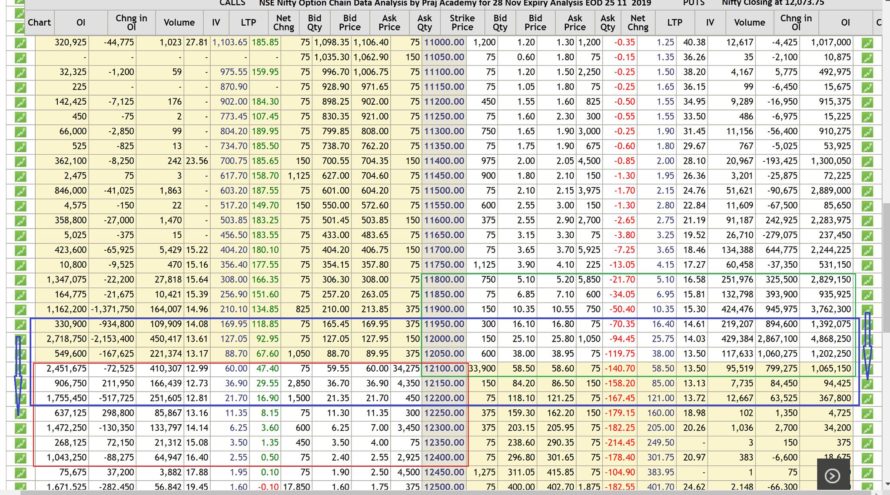

In Option chain data, Put writing was seen at 12,000, 12,050, and 12,100 levels while as an unwinding of calls seen at 12,000, 12,100, 12,200, 12,300 and 12,500 levels. This indicates that the support at higher levels has strengthened while resistance at the upper level is weakened. Looking at the Open Interest data and the PCR at 1.51 for Nov 28 series and positions of various participants, the market range seems to be in the range of 11,950 to 12,150 for intraday with bullish bias. Some profit booking may be expected as Nifty approaches 12,150, which may turn the market volatile and choppy in intraday. Despite positive global cues, the equity benchmark indices ended today’s session sharply lower than the opening price.

Technical analysis with a sound understanding of the market is the key to trading success, however, sometimes market forces are stronger than the past analysis. Unexpected (domestic or international) factors make the technical analysis go haywire for a while, hence we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money. We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!