And where is Nifty heading to on weekly expiry on Oct 17, 2019?

Nifty started the day with a good gain of 36.65 points and positive momentum that saw the days high at 11,481. At higher levels, Nifty saw some profit booking and it could not sustain for a long time. Thus the sell-off pulled nifty to days low at 11,411.10, bulls at the end of the day managed the day and closed the day where it started at 11,464 making an indecisive Doji on daily chart at 61.8% Fibonacci retracement of 23 September High to low. The day was volatile but made a higher high and higher low candles for the day. Today, the DIIs were net buyers 1576.73 while FIIs were net buyers with 686.33. From the Nifty50 stack, 30 stocks advanced and 19 declined.

Today’s closing at 11,464 is above the daily Pivot at 11,411, weekly Pivot at 11,252.70 and 200 DEMA at 11,229. The Index has got multiple layers of resistance to cap the upside on the daily and 60 minutes charts. Stochastic has moved up quickly to overbought zone and is at 87 thus indicating for consolidation or a small correction. RSI has strengthened and it is at 58 while MACD is still above zero with a bearish crossover changing the direction. Nifty needs strong domestic and international cues to cross 11,495 levels decisively to continue its bullish journey towards 11,510 and subsequently 11,600.

The daily resistance levels are at 11,475, 11,510, 11,543 and 11,600. The support levels can be seen from the Nifty Daily chart at 11,463 (61.8% Fib of recent low), 11,414, 11,392, 11,345, 11,321, 11,300, 11,278, 11,165 and 11,232. If Nifty breaks below 11,400 on closing and the sustainable basis on the daily chart, it may consolidate or correct for a while. Looking at current immediate support and resistance level for the next trading day seems to be from 11,250 to 11,550.

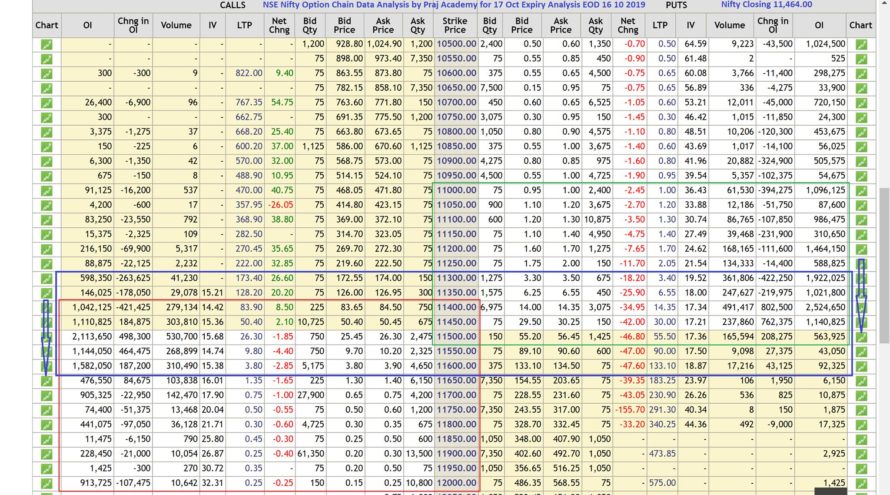

New Put writing was seen at higher levels like 11,400, 11,450, 11,500 and put unwinding was seen at 11,00 to 11,300 levels shifting support base upside. Call writing was seen at 11,400,11500 and 11,600 levels while unwinding was seen at 11,440 and 11,300 levels thus shifting resistance levels upside. Also, Option data is a wider range now indicating volatility in the coming week. Looking at the Open Interest data at various strike rates along with the strike shifting forces indicate the possibility of the next trading range between 11,300 and 11,550. The PCR @EOD has decreased 1.37 from 1.41. which indicates mild bullish bias with consolidation.

Technical analysis with a sound understanding of the market is the key to trading success, however, sometimes, unexpected (domestic or international) factors make the technical analysis go haywire for a while. Market forces are stronger than our analysis sometimes, and we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money.

We trust the information will be helpful in your own analysis of the market and make trading a profitable and better experience. This analysis has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!