And where is Nifty heading to with new weekly series expiring on Oct 17, 2019?

Nifty started with good momentum in the morning with a gap up of 23.15 points and touched days high at 11,362 where sharp profit booking started. With-in 45 minutes of sharp fall, it saw the days low at 11,189 and got buying at 50% retracement of recent high on 23 September. The swift buying in IT, Auto, Metal and FMCG sector lifted the NIfty again closing the volatile day at 11,303.05 with a net gain of 70.50 points. The US-China trade uncertainty, international markets and outcome of the informal summit today between Modi-Xi in India will e some of the factors impacting the market next week. The daily chart reflects an out-candle consolidation with spinning top candle which shows indecisiveness. The weekly chart closed with a bullish hammer keeping the hopes of bulls alive. After many days today pattern changes and the DIIs were net sellers with -703.02Cr while FIIs were net buyers with 749.74Cr. Total 35 stocks advanced and 15 declined from the Nifty50 stack.

Today’s closing at 11,303 is above the daily Pivot at 11,245.48, weekly Pivot at 11,295.77 and 200 DEMA at 11,222. The Index has got multiple layers of resistance to cap the upside on the daily and 60 minutes charts. Stochastic has moved up quickly and is at 54.64. RSI remains sideways at 53.64 while MACD is still above zero with a bearish crossover. Nifty is under the consolidation phase and it needs strong domestic and international cues to cross 11,400 level decisively to continue its bullish journey towards 11,463 and subsequently 11,695.

The daily resistance levels are at 11,321, 11,350, 11,390, 11,416 and 11,463 (61.8% Fib of recent low). The support levels can be seen from the Nifty Daily chart at 11,300, 11,278, 11,165, 11,232, 11,182, 11,137, 11,090, 11061.65 (61.8% Fib Level from recent high) and 11,000. If Nifty breaks below 11,061 on closing and the sustainable basis on the daily chart it may revisit old low at 10,670. Looking at current immediate support and resistance level for the next trading day seems to be from 11,137 to 11,463.

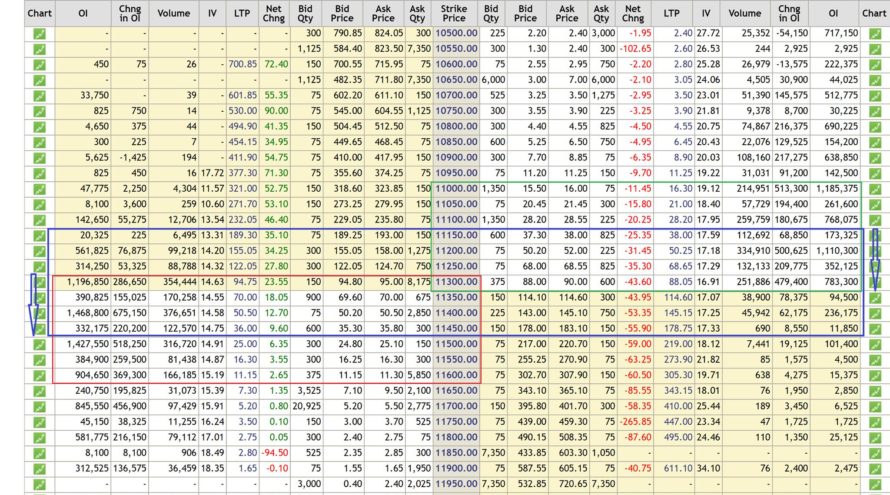

New Put writing was seen at 11,100,11,200, 11,300 levels, and Call writing was seen at 11,400,11500 and 11,600 shifting support and resistance levels broader side indicating more volatility in the coming week. Looking at the Open Interest data at various strike rates along with the strike shifting forces indicate the possibility of the next trading range between 11,100 and 11,500. The PCR @EOD remains low at 0.86, which indicates a neutral stance with a mild bearish bias.

Technical analysis with a sound understanding of the market is the key to trading success, however, sometimes, unexpected (domestic or international) factors make the technical analysis go haywire for a while. Market forces are stronger than our analysis sometimes, and we have to monitor fresh data and new dynamics of the market during trading hours to consistently make money.

We trust the information provided will be helpful in your own analysis of the market and make trading a profitable and better experience. The information has been shared for educational purposes. Please seek your financial adviser’s guidance before trading or investing.

Happy Trading and Keep investing safely!